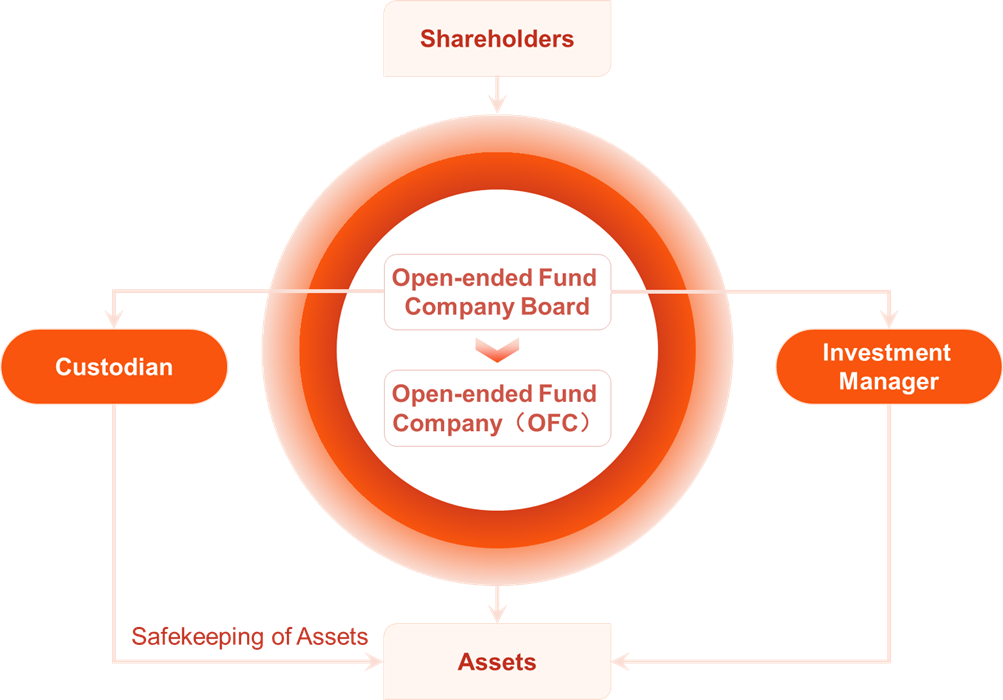

An OFC is an open-ended collective investment scheme which is structured in corporate form with limited liability and variable share capital. The main purpose of an OFC is to serve as an investment fund vehicle and manage investments for the benefit of its shareholders.

Being an investment vehicle, OFCs are NOT designed to engage in activities, such as commercial trade and business, undertaken by conventional companies which are incorporated under the Companies Ordinance (Cap. 622). OFCs are incorporated in or re-domiciled to Hong Kong under the Securities and Futures Ordinance (Cap. 571).

Corporate funds are more popular with investors internationally.

Saves management time and costs by dealing with only one jurisdiction instead of two.

Avoid extra offshore layer of service providers.

Public OFCs: No new fees - only the existing fees for public funds.

Private OFCs: Basic registration and post-registration fees for on per change basis.

"One-stop" approach, subject to basic requirements only.

No annual returns nor mandatory annual general meetings.

OFCs eligible under the scope of MRF arrangements with various overseas regulatory authorities, including FINMA (Switzerland), AMF (France), FCA (UK), CSSF (Lux), AFM (Netherlands) and SEC (Thailand).

Hong Kong-domiciled SFC-authorized funds (including SFC-authorized OFCs) will be eligible under the GBA Wealth Management Connect scheme.

Public OFCs can be exchange-traded funds (ETFs), in this context, public OFCs may be qualified products under Cross-listing Scheme and Stock Connect Program of ETFs.

Hong Kong’s robust financial infrastructure, and Hong Kong’s sound regulatory system which adheres to international standards.

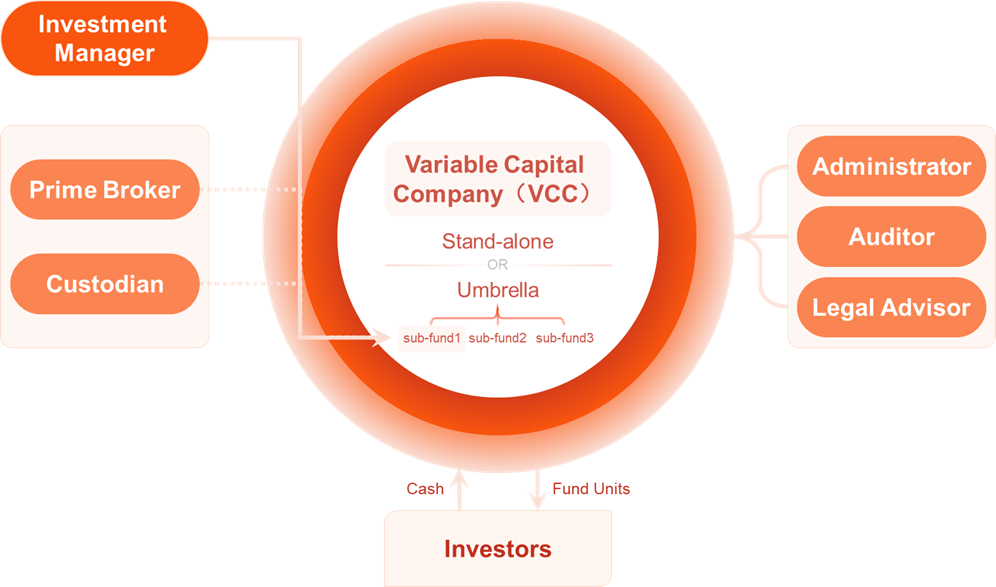

Variable Capital Companies (VCC) is a fund scheme newly launched by Singapore.

The new legal entity, regulated by the Variable Capital Companies Act (VCC Act), can be structured as a stand-alone fund or umbrella fund with multiple sub-funds, and can be utilized for traditional and alternative fund strategies, either open-ended or closed-ended.

VCC has a variable capital structure with the flexibility to issue and redeem shares without having to seek shareholder’s approval.

VCC enables fund managers to pay dividends to investors who wish to exit their investments in the investment fund.

VCC are not subject to restrictions on capital reduction (equivalent to fund redemptions) and on payment of dividends only out of profits, applied to Singapore companies in general.

VCC will be treated as a company and a single entity for tax purposes. In this case, only one set of income taxes is required to be filed with the Inland Revenue Authority of Singapore. In addition, the tax exemption under sections 13R and 13X of the Income Tax Act (Cap. 134) of Singapore will be extended to VCCs.

As the multiple sub-funds are under the same umbrella fund, they can benefit from economies of scale and achieve cost efficiency. The sub-funds can share a board of directors and have common service providers, such as the same investment manager, custodian, auditor and administrative agent.

According to VCC Act, the investment fund established outside Singapore can become a VCC through a re-domiciliation mechanism. This mechanism enables existing funds domiciled in overseas jurisdictions with similar structures to VCC to re-domicile in Singapore and to consolidate their pooling investment activities. In addition, fund managers can also choose to set up a new VCC in Singapore and transfer the assets and liabilities of the original fund to a VCC.

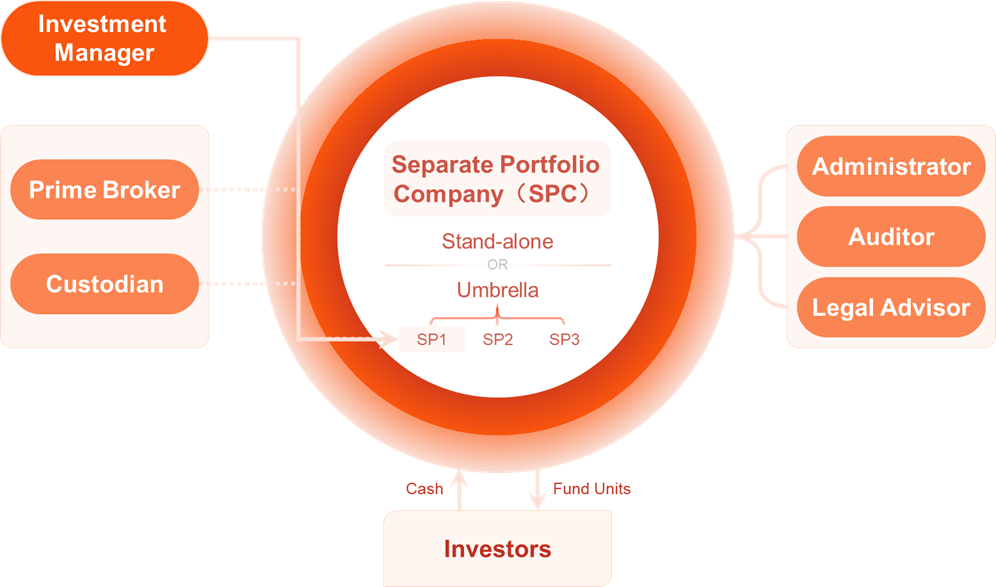

An SPC is an independent legal entity, a Cayman domiciled offshore fund with separate portfolios with its own balance sheet, NAV, and accounts status so that investors in different portfolios are legally protected from each other’s silo.

VAM handle your middle and back-office operations here in Hong Kong, and we’ve partnered with the best administration, legal, audit, custody, and technology partners to serve your fund portfolio.

One or multiple Segregated Portfolios (SP) can be set up in an SPC with an unlimited number. There are no restrictions on the investment target invested by each SP within SPC, which can meet the personalized needs of specific investors.

The independent assets and responsibilities of each SP are the most prominent feature of SPC, which is also an important reason for its popularity in the industry.

Specifically, the assets and responsibilities of SPC and all SPs are independent from each other; the assets and responsibilities of each SP are also independent of each other.

Despite the distinction between assets and responsibilities, the SPC is still a complete entity and does not separate in corporate personality, which means that the investment manager does not need to set up separate legal entities for different investors or investment needs.

Only one SPC is needed to realize the investment and management of multiple different assets and achieve "one world, different dreams". From the perspective of cost and efficiency, SPC has huge advantages.

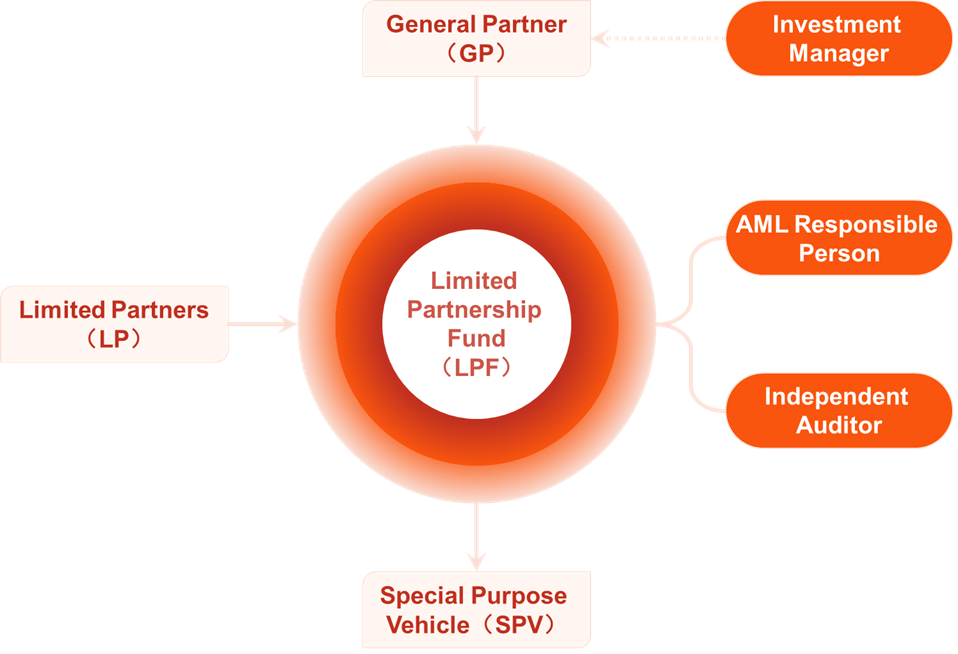

An LPF is a fund that is structured in the form of a limited partnership and is used for the purpose of managing investments for the benefit of its investors. An LPF is not a legal person.

A fund must meet the eligibility requirements under section 7 of the Limited Partnership Fund Ordinance (the Ordinance) to qualify for registration as an LPF. The limited partnership fund regime is an opt-in registration scheme and does not enforce funds in form of limited partnerships to be registered in accordance with the Ordinance.

No restriction on investment scope.

Flexibility in capital contributions and distribution of profits.

Contractual freedom among partners.

Broad safe harbor activities for limited partners.

Straightforward deregistration and dissolution mechanism.

Aligns fund structures with the location where asset management activities take place enabling a streamlined fund structure.

Enhances substance of the fund for tax treaty relief.

May qualify as a Hong Kong tax resident and increased likelihood of obtaining Hong Kong tax residence certificate for Hong Kong SPVs.

Nominal fee for registering a LPF with the Hong Kong Companies Registry.

0.8% capital duty will not apply to contributions from limited partners.

Hong Kong profits tax exemption under the Unified Funds Exemption regime provided certain conditions are met.

Interest in LPF is not a “stock” and no stamp duty will apply when an interest in LPF is contributed/ transferred/ withdrawn.

Streamlined channel for any funds already registered under the LPO.

Information about limited partners will be confidential and not available for public inspection.

Investors will be provided with clear protection under Hong Kong law.

Regulated Entities Under Victory Finance Group:

VICTORY SECURITIES (GLOBAL) LIMITED

Victory Securities (Global) Limited (CE No.: BRA946) is a licensed corporation of the Securities and Futures Commission of Hong Kong holding Type 1 ("Dealing in Securities") and Type 2 ("Dealing in Futures Contracts") licenses.

VICTORY ASSET MANAGEMENT LIMITED

Victory Asset Management Limited (CE No.: BOT221) is a licensed corporation of the Securities and Futures Commission of Hong Kong holding Type 4 ("Advising on Securities") and Type 9 ("Asset Management ") licenses.